Exports flow types #

Types of flows for exporting products from Turkey:

- Sampling: non-commercial product delivery abroad. VAT refund is not available.

- Micro export: commercial product delivery abroad.

Micro export flow allows a VAT refund for the production or purchase of products. You can get the refund in one of the following ways:

- receive money to your company account once a month;

- receive payments reduction on other taxes for your business in the next quarter after you apply for a refund.

Refund amount depends on the product category as well as whether you produce your products yourself or purchase them for further reselling purposes. Your accountant can provide all the necessary information on it.

We recommend working with YMM (Yeminli Mali Müşavir)—certified accountants when applying for a VAT refund. These specialists know the process and can deal with all paperwork related to it.

To reduce prices or increase revenue using the money you receive, learn the steps to get a VAT refund.

When you send your products under the micro export scheme, the total cost per shipment cannot exceed €15,000 and the maximum weight is 300 kg.

VAT return process under the micro export scheme #

Document preparation #

In order to ship your products abroad, your company should be registered as a legal entity in Turkey.

Before you start selling on Ozon, you need to make sure you have the E-Arşiv Fatura (electronic tax invoice)—a document you fill out with information on every package you want to ship.

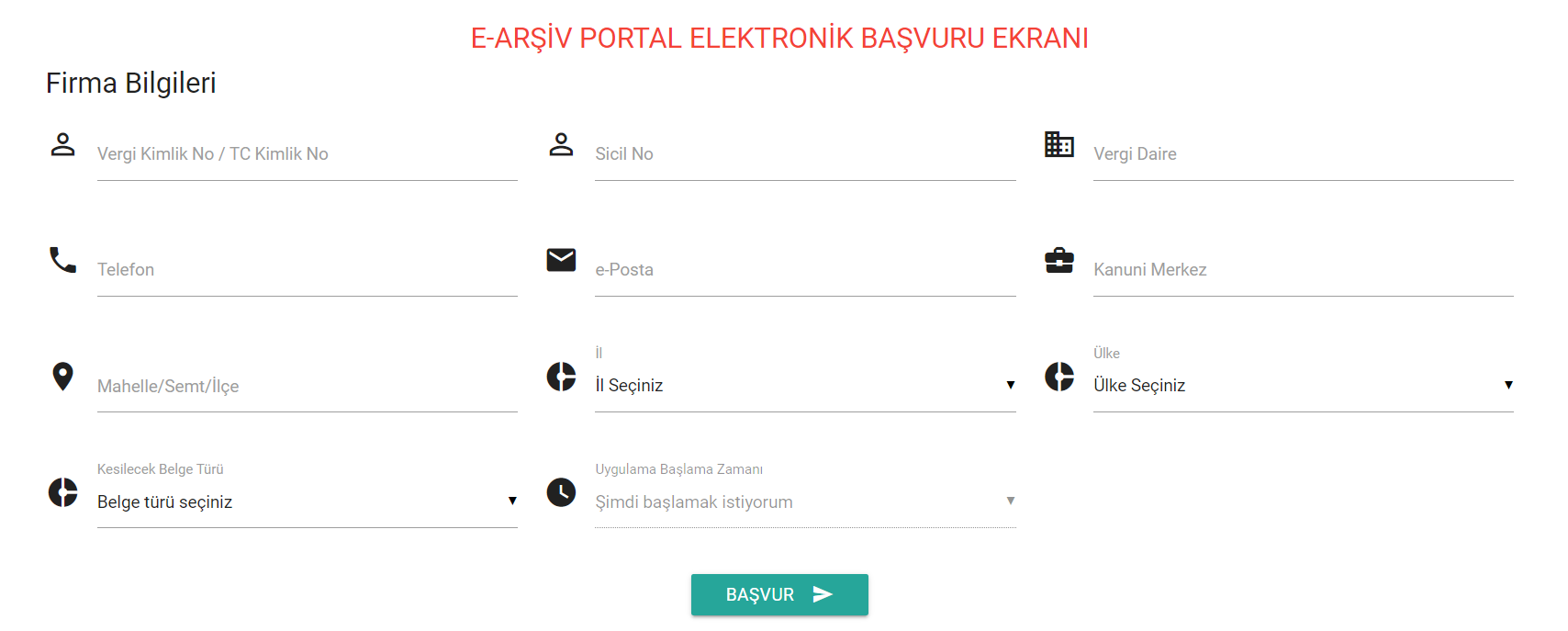

To get this document, fill the form on the E-Arşiv Portal Giriş Ekranı website.

Once you have submitted the necessary information, the invoice will be ready for download.

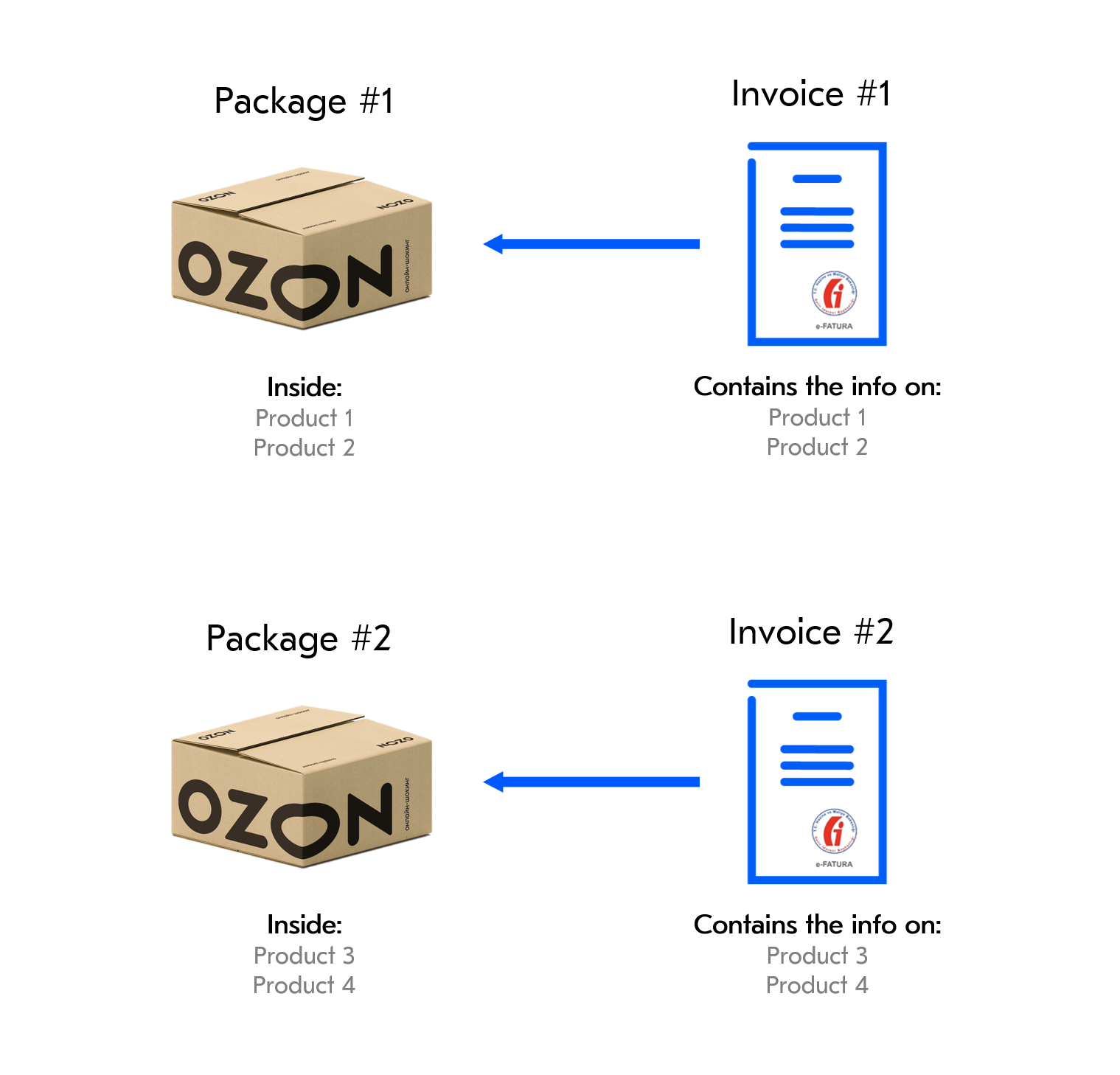

When you have received an order and are packaging your products, you need to fill out the invoice for every package. For example, if your first package has product 1 and product 2 in it, the invoice for it needs to have the information about these two products. Then you need to stick the invoices on top of the packages accordingly:

An invoice attached to the shipment will help your products get through customs.

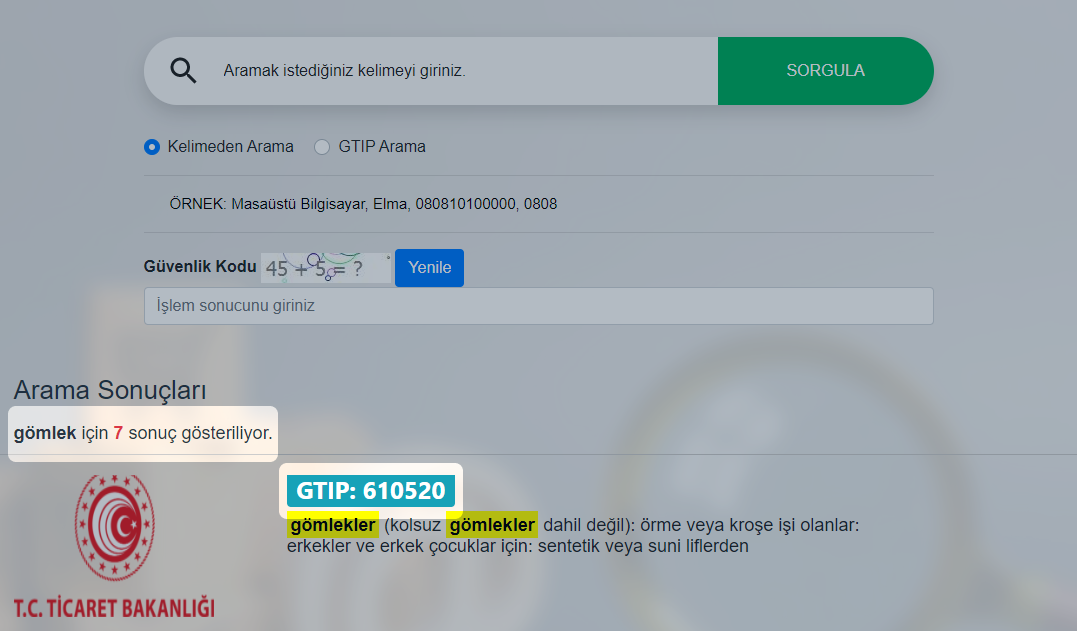

While you are filling out the invoices, you will need the Gümrük Tarife Istatistik Pozisyonu—GTIP (HS Code). This is a code with detailed information about products. To find out what GTIP each of your products has, specify what you sell on the Tarife Arama Motoru website. There may be more than one code for each category. Select the appropriate option and enter it in the corresponding field on the invoice. You can also describe your product in detail.

The code has 6-12 digits in it.

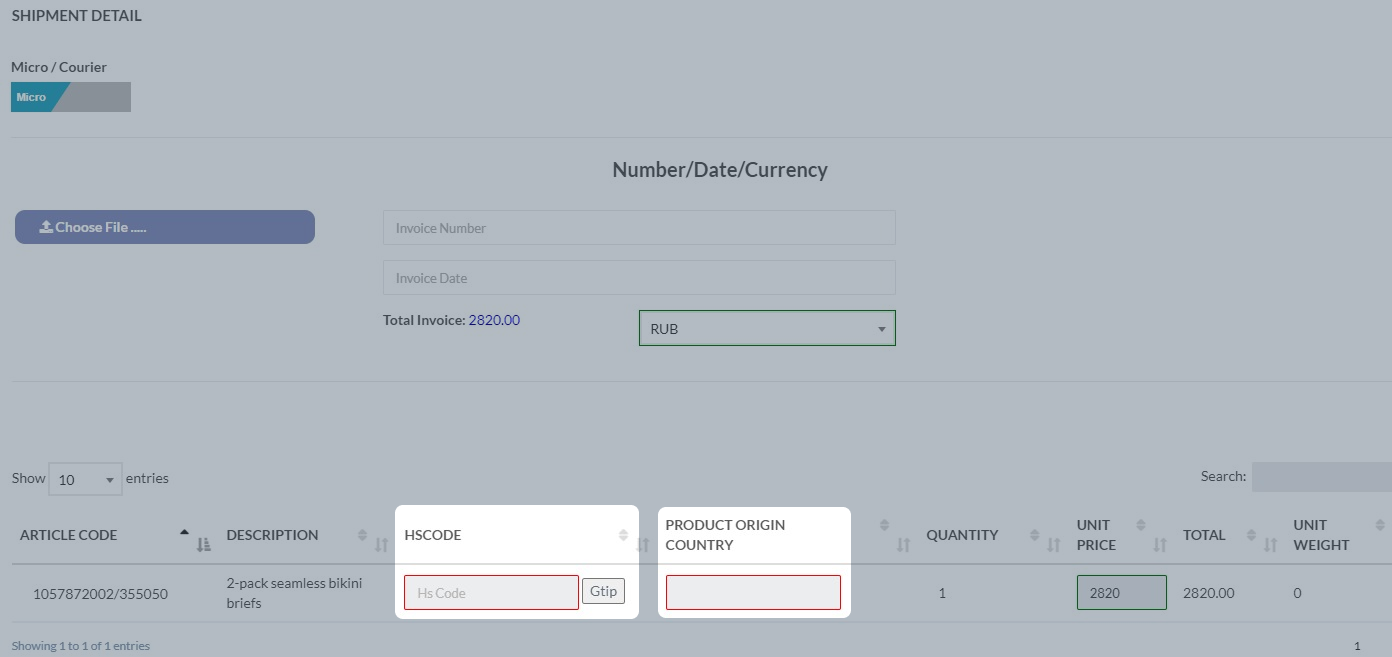

Pay special attention to filling out the fields with HS Codes and Product Origin Country. Invoices that are filled out incorrectly lead to customs fines. Logistics providers charge sellers for these expenses.

When you have packaged your products and stuck the invoices to them, transfer the shipments to the shipping carrier’s warehouse.

Document handover to shipping provider #

-

Via your personal account:

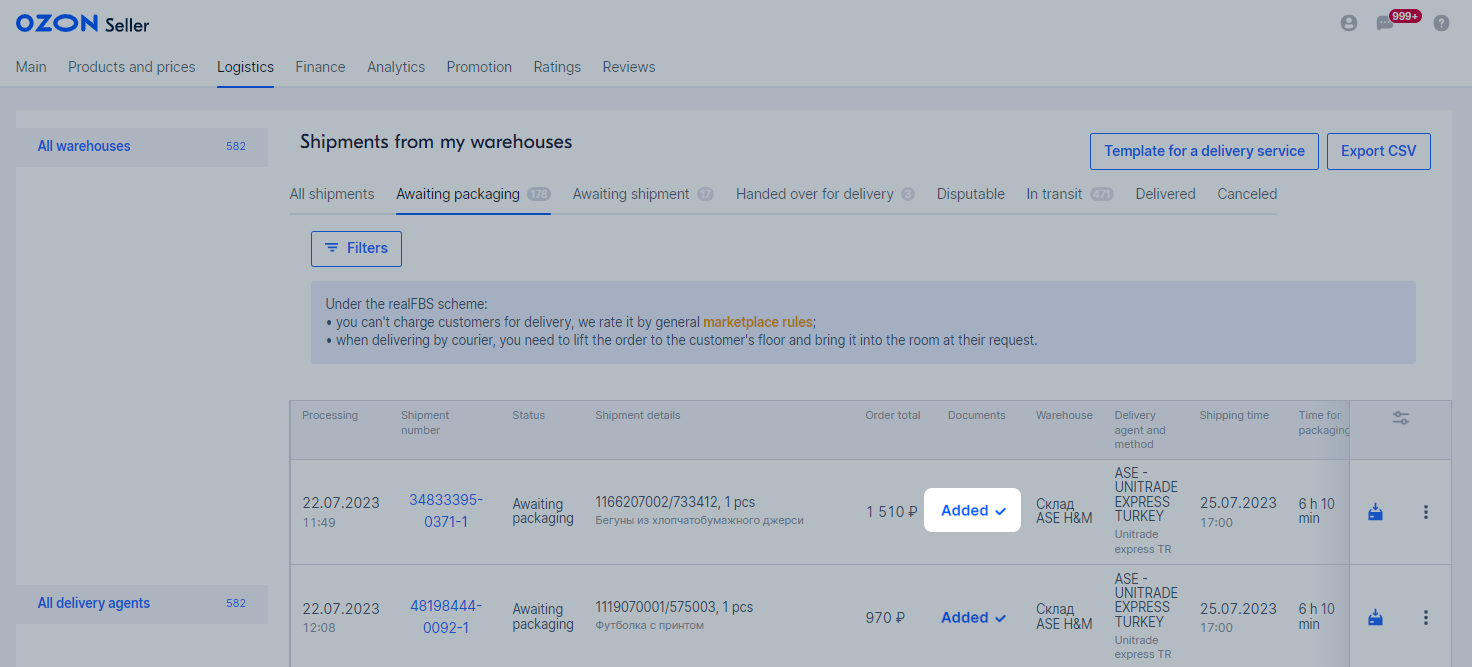

Available only when working with TTerminal and PTS & GBS Broker before clicking Pack order.- In the Logistics → Orders from my warehouse section open the Awaiting packaging tab.

- In the “Document” column, click Add or go to the order card by clicking its number.

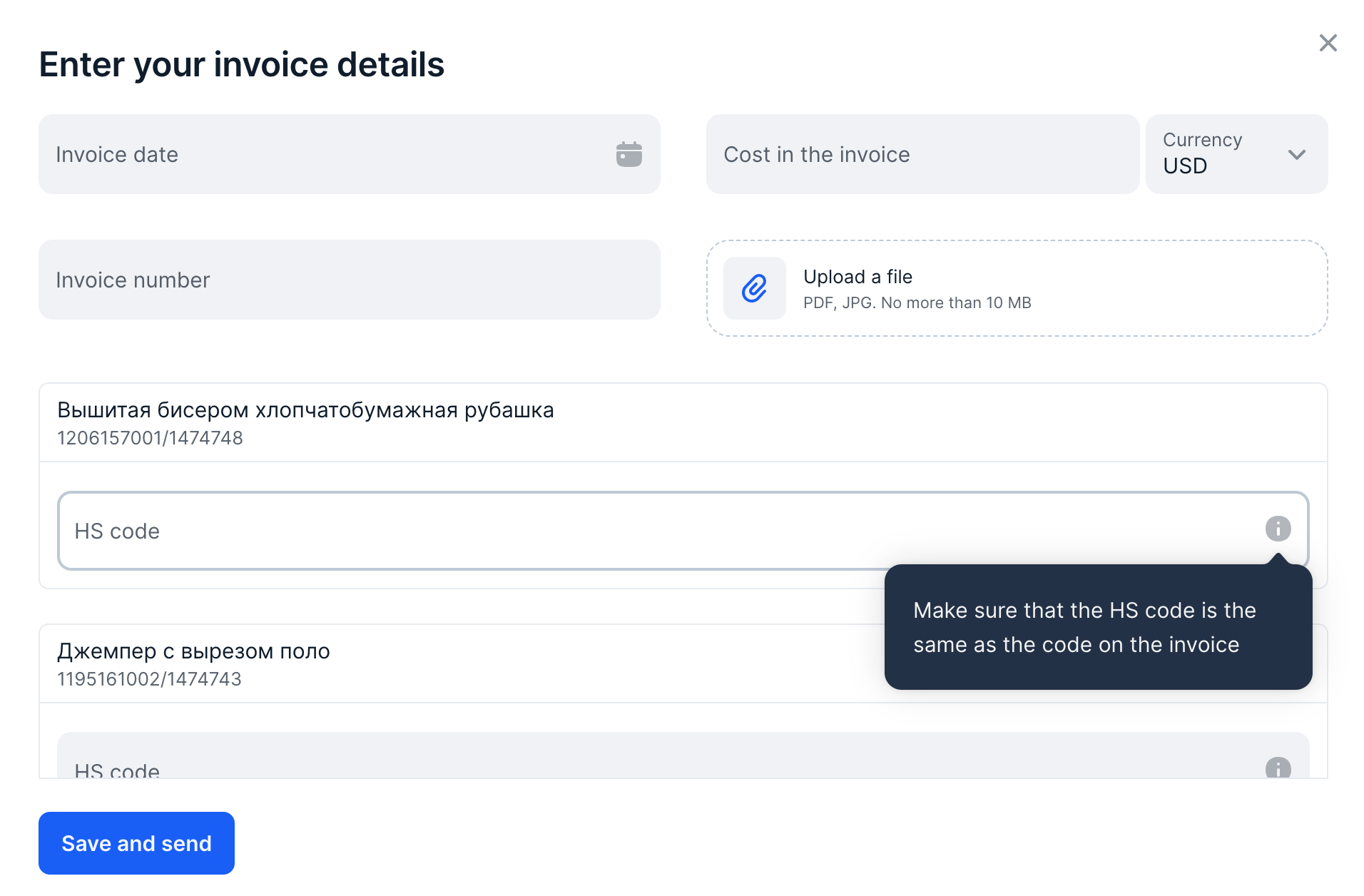

- Fill in all the fields and upload the invoice in PDF or JPG format.

Make sure to fill in the HS code for each product.

Make sure to fill in the HS code for each product.- Click Save and send.

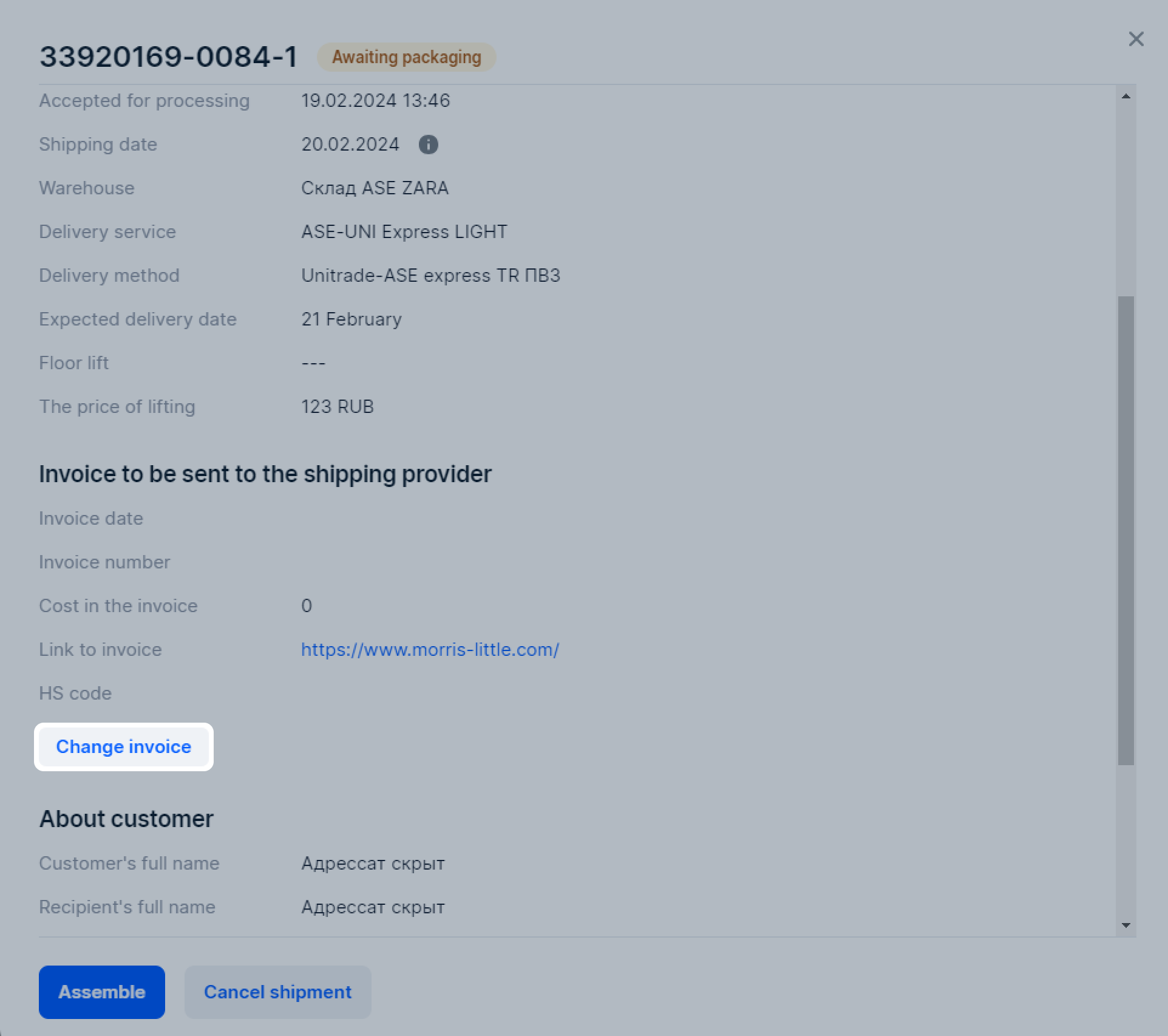

You can create and edit an invoice if the shipment is in the “Awaiting shipping” status. After clicking Assemble, you can’t make changes to the invoice.To edit information, change or upload a new tax invoice, in the “Document” column click Added → Edit or in the order card click Change invoice. You can edit the tax invoice before registering the order with the shipping provider.

-

Other means of document handover.

Provide printed copies of invoices when you deliver your products to their warehouse.

Document receipt from carrier #

Your shipping provider uses invoices to carry out micro export and prepare the Elektronik Ticaret Gümrük Beyannamesi—ETGB (electronic customs invoice). Depend ing on the chosen shipping provider, you can receive the customs invoice via:

-

Personal account:

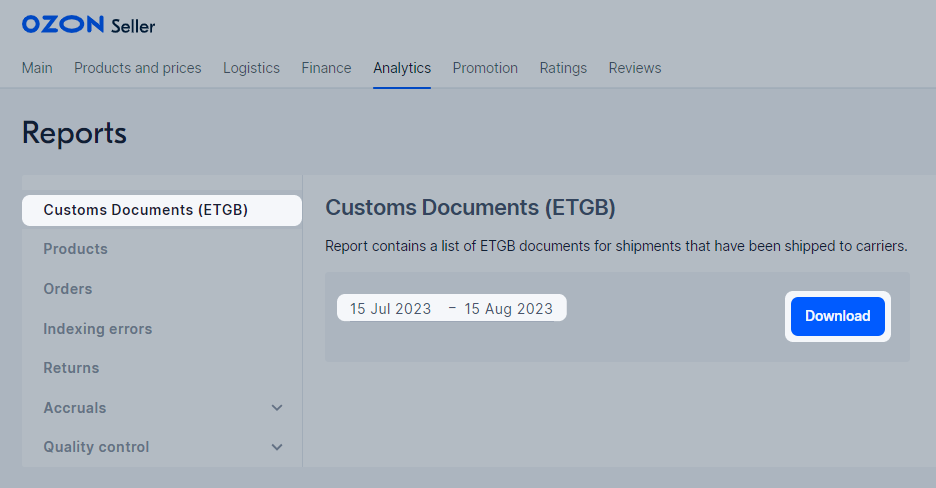

Available only when working with TTerminal and PTS & GBS Broker.- In the Analytics → Reports or Finance → Documents section open the Customs Documents (ETGB) tab.

- Select the period for receiving the report and click Download.

-

Request to the shipping provider:

Request your customs invoice at cs@pts.net. The carrier is ready to provide this document the next day after the products have been exported. For example, if you bring your products to the pick-up point on Monday, and they are exported on Tuesday, the tax invoice will be ready on Wednesday. If you don’t receive your tax invoice, contact the carrier using the email address above.

Once the tax invoice is with you, your accountant can start the process of applying for a VAT refund by requesting it from the Tax Office.